Whole Life Insurance

Whole Life Protect+ and Whole Life Perform+ offer two powerful solutions with built-in living benefits,1 payment options, and accelerated underwriting available up to $1 million.

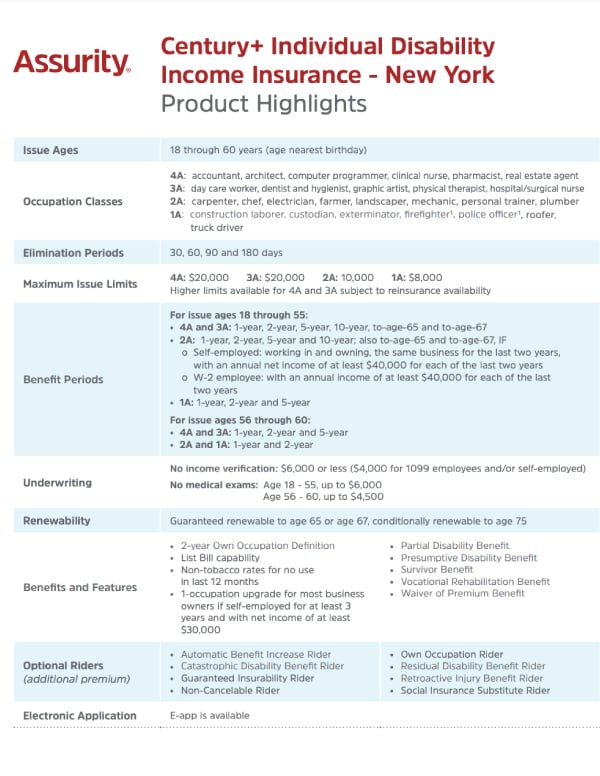

Highlight Sheet

Seller's Guide

On-demand Training

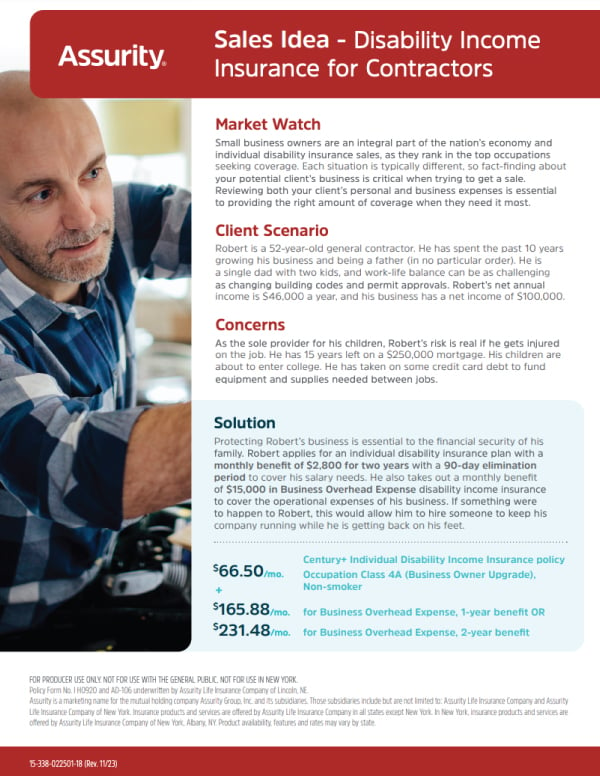

Sales Ideas

Key Features

- Whole Life Protect+ maximizes the death benefit at an affordable cost

- Whole Life Perform+ leverages cash value accumulation

- Face amounts from $10,000

- Accelerated underwriting and no exams available up to $300,0002 for ages 15 days-17; $1 million for ages 18-50; $500,000 for ages 51-65; $100,000 for ages 66-85

- Built-in living benefits allows clients facing a chronic, critical or terminal illness to accelerate a portion of their death benefit1

- Multiple payment options:10-pay, 20-pay, pay to age 65 and pay to age 1003

- Optional riders like the Critical Illness Rider and Level Term Rider enhance benefits and extend coverage for families

Get Product and Training Materials

1. Accelerated Death Benefit Rider is included in states where allowed. The chronic illness and critical illness benefits are included through issue age 70.

2. Financial documentation required for benefit amounts over $100,000.

3. Issue ages for 10-pay, 20-pay and pay to age 100: 15 days to 85 years; issue ages for pay to age 65: 15 days to 54 years.