Single Premium Whole Life Insurance

Level benefit single-premium whole life coverage that immediately increases estate value and allows for tax-deferred cash value growth.1

Highlight Sheet

Seller's Guide

On-demand Training

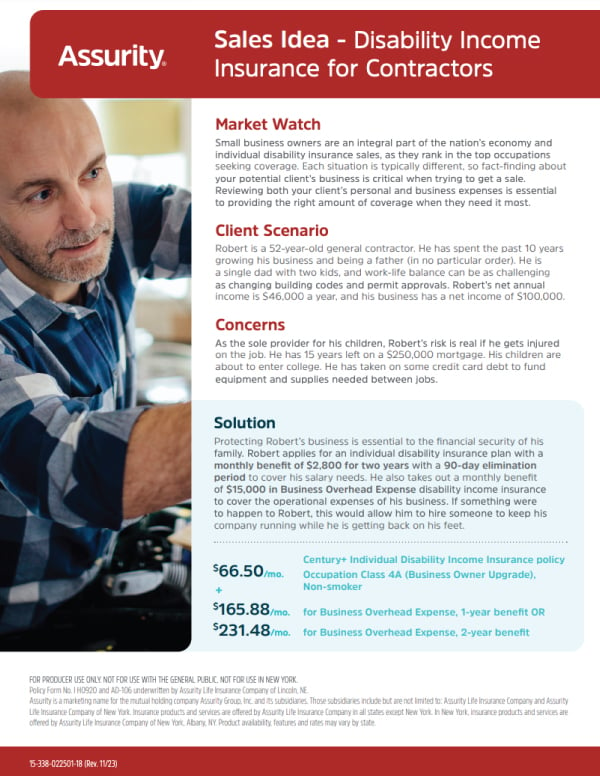

Sales Ideas

Key Features

- Extended issue ages from 15 days-85 years

- No medical exams for issue amounts up to $700,000 for ages 0-60; up to $450,000 for ages 61-85

- A single, lump-sum payment simplifies the sale

- Dividends available2

-

Immediate increase in estate value, along with continued, tax-deferred accumulation of cash value that can be accessed at any time for any purpose1

- Acceleration benefits for chronic and terminal illness3

Get Product and Training Materials

1 Early-year cash values will be less than the premium paid. The policy loan interest rate will vary. Policy loans and withdrawals reduce the death benefit.

2 Dividends are not guaranteed and are determined by Assurity’s experience relative to assumed mortality, investment performance and expenses.

3 Accelerated Death Benefit Rider is included in states where allowed. The chronic illness benefit is included through issue age 75. Accelerated benefits reduce the death benefit