Targets and Prospects

The need for disability insurance has never been higher:

• 65% of private sector workers have no long-term disability insurance1

• 77% say they would struggle to pay bills after just one week without income2

Help your clients stay secure if a disability strikes with flexible, affordable coverage designed for middle income Americans.

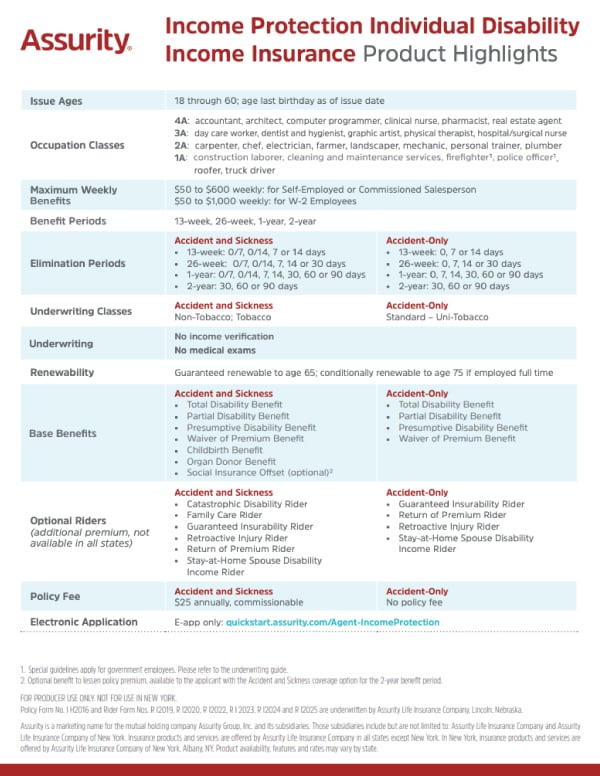

Highlight Sheet

Seller's Guide

On-demand Training

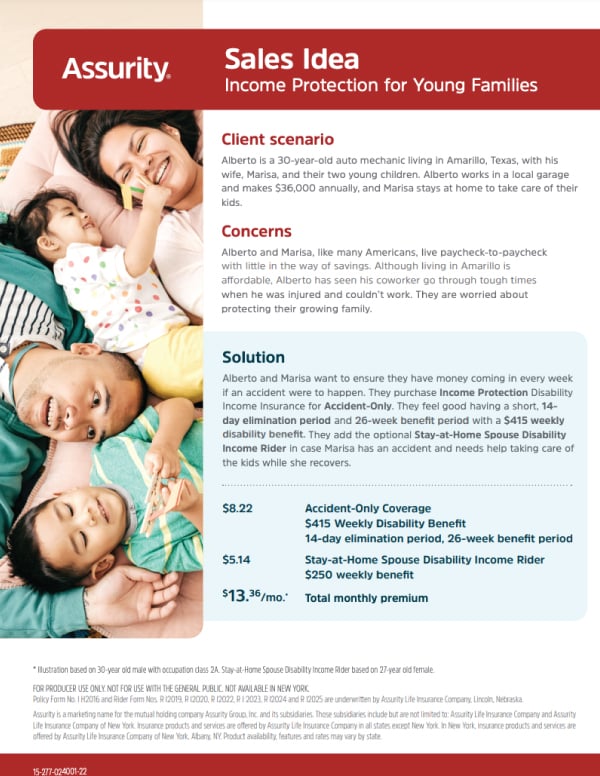

Sales Ideas

Where We Fit Best

As a longtime leader in the DI space, we see the markets where disability coverage is needed most. Our products are perfectly suited for working professionals in the middle market, providing protection that does more at an affordable price. You may see success with occupations that frequently see the consequences of disability, like nurses and physical therapists. We tend to see more men than women purchasing long-term DI coverage (65% versus 35%), while women see more value for short-term DI due to its pregnancy benefits and ability to combine with long-term DI.

Small Business Owner Advantages

Small business owners have a larger need than most people for disability insurance, as their income pulls double duty for their family and their business. Help them get more from their coverage with options just for them on Long-Term DI and Business Overhead Expense DI.

• 20% Multi-Life Discount on Income Protection+ for 3 or more insureds from the same employer

• 20% Small Business Income Enhancement

• Business Owner Occupation Class Upgrade

• 5% Discount on BOE for 3 or more policies issued at the same employer

Where We Fit Best

As a longtime leader in the DI space, we see the markets where disability coverage is needed most. Our products are perfectly suited for the middle market, providing protection that does more at an affordable price. You may see success with occupations that frequently see the consequences of disability, like nurses and physical therapists. We tend to see more men than women purchasing long-term DI coverage (65% versus 35%), while women see more value for short-term DI due to its pregnancy benefits and ability to combine with long-term DI.

• Nurses

• Contractors

• Physical therapists

• Real estate agents

• Freelance workers

• Young families

• People planning for retirement

Conversation Starters

Ask these questions to help your clients realize the value of protecting their income.

• How much income would you need to support your family if you could no longer work due to illness or accident?• How long would your savings last if you were unable to work?

• How would you afford to pay your mortgage or rent if your paycheck stopped?

• You insure your car and your home – why not your income?

• What’s the most important asset you have?

1. Social Security Basic Facts, 2025

2. National Payroll Week Survey, 2025

3. U.S. Market Snapshot, Bureau of Labor and Statistics, 2024