Course Outline

- Course Overview

- Overview

- Instructions

- Annuity Suitability Best Interest

- Suitability/Best Interest Assessment

- Suitability/Best Interest Assessment: Purchase & Replacement

- Suitability Acknowledgement / Consumer Profile Information Form

- Common Policy Features

- Single-Premium Deferred Annuities: Premiums and Fees

- Interest Rates

- Policy Surrender

- Policy Maturity

- SPIA: Premiums

- SPIA: Payout Options

- Take the Quiz (8 Questions)

Policy Surrender

Policy Surrender

- May be surrendered at any time prior to the maturity date for the surrender value

Payment Options at Surrender

- Available as lump sum

- Available as annuity benefits – life income, fixed period, life income with guaranteed period and other options upon request

- If no option is selected, the surrender value will be paid out as lump sum

- Payment may be deferred six months

Surrender Value

- Annuitant’s account reduced by any applicable surrender charge

Surrender Charges

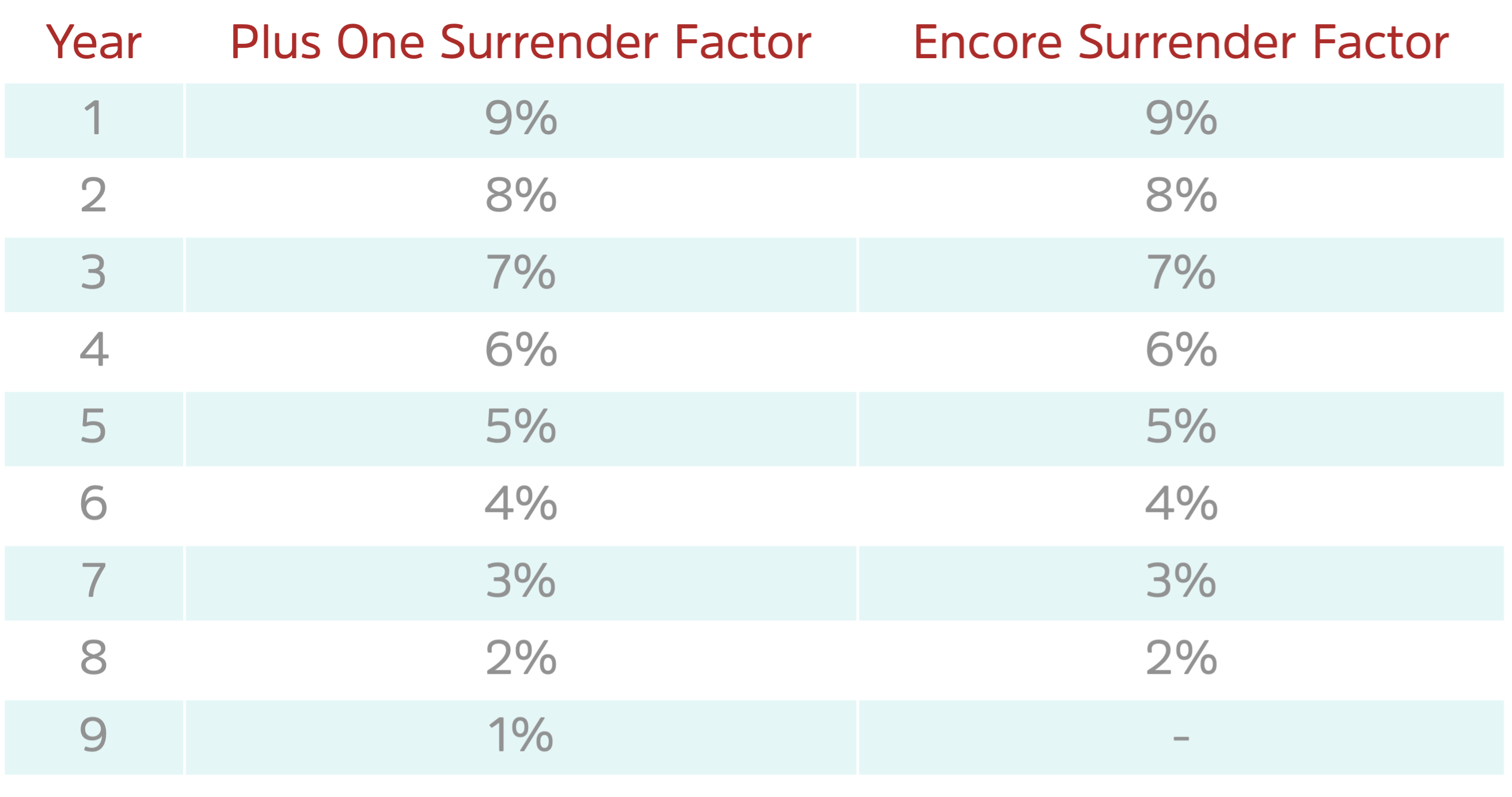

- Calculated by multiplying excess over “withdrawals free of surrender charge” by factor according to year of surrender:

Withdrawals Free of Surrender Charge

- Up to a percent of the annuitant’s account less any amount withdrawn in the prior 12 months

Plus One – 10 percent; Encore – 12 percent

- Under special circumstances, up to 100 percent of annuitant’s account may be withdrawn free of surrender charges: (circumstances vary by state):

- after the surrender period;

- the annuitant is totally disabled as defined by policy;

- selecting a payment option after the first policy year providing payment for life or at least five years; or

- after being confined in a nursing home for a number of consecutive days after the issue date

Plus One – 30 days; Encore – 45 days