Course Outline

- Course Overview

- Overview

- Instructions

- Annuity Suitability/Best Interest

- Suitability/Best Interest Assessment

- Suitability/Best Interest Assessment: Purchase & Replacement

- Suitability Acknowledgement / Consumer Profile Information Form

- Common Policy Features

- Single Premium Deferred Annuities: Plus One and Encore Annuities

- Single-Premium Deferred Annuities: Premiums and Fees

- Interest Rates

- Policy Surrender

- Policy Maturity

- Single Premium Deferred Annuities SecurePath Multi-Year Guaranteed Annuity (MYGA)

- MYGA: Premiums

- MYGA: Interest Rates

- MYGA: Policy Surrender

- MYGA: Options After Guaranteed Interest Rate Period

- MYGA: Payment Options

- SPIA: Premiums

- SPIA: Payment Options

- Take the Quiz (10 Questions)

Policy Surrender

Both the Plus One and Encore annuities may be surrendered at any time prior to the maturity date for the surrender value.

This amount is available as a lump sum or as one of the following annuity payment options:

- life income

- fixed period

- life income with guaranteed period, or as other options available upon request

If no payment option is selected, the surrender value will be paid out as a lump sum. Payment may be deferred up to six months. The surrender value is the annuitant’s account reduced by any applicable surrender charge.

Policy Surrender

- May be surrendered at any time prior to the maturity date for the surrender value

Payment Options at Surrender

- Available as lump sum

- Available as annuity benefits – life income, fixed period, life income with guaranteed period and other options upon request

- If no option is selected, the surrender value will be paid out as lump sum

- Payment may be deferred six months

Surrender Value

- Annuitant’s account reduced by any applicable surrender charge

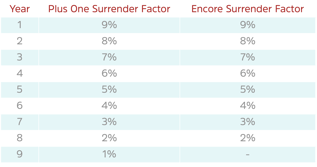

Surrender charges are calculated by multiplying the withdrawal, in excess of the withdrawal free of surrender charge, by the appropriate factor according to the year of surrender.

For the Plus One annuity, factors for years 1 through 9 are: 9 percent, 8 percent, 7 percent, 6 percent, 5 percent, 4 percent, 3 percent, 2 percent, and 1 percent.

For the Encore Annuity, factors for years 1 through 8 are: 9 percent, 8 percent, 7 percent, 6 percent, 5 percent, 4 percent, 3 percent, and 2 percent.

Surrender Charges

- Calculated by multiplying excess over “withdrawals free of surrender charge” by factor according to year of surrender:

As mentioned, some proceeds may be withdrawn penalty free. These “withdrawals free of surrender charge” are available up to a percentage of the annuitant’s account, less any amount withdrawn in the prior 12 months.

For the Plus One annuity, the percent that can be withdrawn free of a surrender charge is 10 percent; for the Encore Annuity, it’s 12 percent.

Under certain circumstances, up to 100 percent of the annuitant’s account may be withdrawn free from surrender charges.

Those circumstances include:

- after the surrender period;

- if the annuitant is totally disabled as defined in the policy;

- selecting a payment option after the first policy year providing payment for life or at least five years; or

- after being confined in a nursing home for 30 consecutive days starting after the issue date.

Please note that these conditions may vary by state and may not be allowed in all states.

Withdrawals Free of Surrender Charge

- Up to a percent of the annuitant’s account less any amount withdrawn in the prior 12 months

Plus One – 10 percent; Encore – 12 percent

- Under special circumstances, up to 100 percent of annuitant’s account may be withdrawn free of surrender charges: (circumstances vary by state):

- after the surrender period;

- the annuitant is totally disabled as defined by policy;

- selecting a payment option after the first policy year providing payment for life or at least five years; or

- after being confined in a nursing home for 30 consecutive days after the issue date